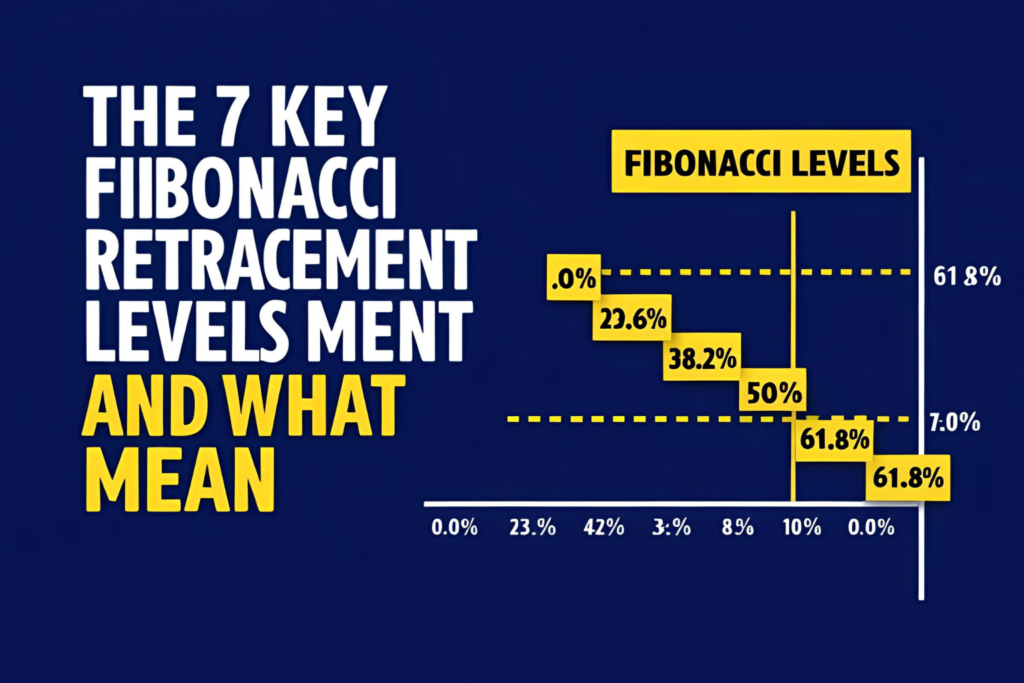

If you’ve worked with Fibonacci retracement in trading, you’ve likely heard the term “golden ratio” used to describe the 61.8% retracement level. But why is 61.8 so important, and how did it earn this title?

In this post, we’ll explain the mathematical origin of the 61.8 ratio and why it’s considered one of the most powerful levels in technical analysis.

What Is the 61.8 Fibonacci Level?

The 61.8% level is one of the standard Fibonacci retracement values used by traders to spot potential support or resistance during a price correction. It represents a deep retracement of the prior move—often viewed as a “last line of defense” before trend reversal.

Why Is It Called the Golden Ratio?

The golden ratio is a number that appears frequently in mathematics, nature, architecture, and art. Its approximate value is 0.618 or 61.8%.

It is derived by dividing one Fibonacci number by the next:

CopyEdit34 ÷ 55 ≈ 0.618

89 ÷ 144 ≈ 0.618

This ratio, also known as phi (φ), reflects perfect proportion. Its natural occurrence in seashells, galaxies, and even human anatomy makes it a fascinating universal constant.

Significance of 61.8 in Trading

In trading, the 61.8% level is widely used because:

- Price often reverses at this level

- It acts as a strong support/resistance zone

- Many institutional traders and algorithms monitor it

It is not magic—it’s psychology. The fact that thousands of traders watch this level gives it real-world relevance.

Example: Golden Ratio in Action

If a stock rises from $100 to $150:

- A 61.8% retracement level = $119.10

If price pulls back to this level, traders often look for bullish reversal patterns to enter long trades, anticipating the uptrend will continue.

Why It Works

- It aligns with natural rhythm and proportion

- It often marks the deepest retracement level before a continuation

- When combined with volume or candlestick confirmation, it becomes a high-probability zone

Final Thoughts

The 61.8 golden ratio is not just a mathematical curiosity—it’s a practical tool that helps traders spot key levels in trending markets. Its reliability comes not from mysticism, but from the fact that so many traders respect and act on it.

When using Fibonacci retracement, always pay close attention to this golden level—it often separates failed breakouts from winning trades.

✅ FAQs

1. Why is 61.8% so accurate in trading?

Because it reflects deep pullbacks where many traders look to enter or exit positions.

2. Is 61.8 unique to Fibonacci retracement?

No—it also appears in Fibonacci extensions, fan lines, arcs, and nature.

3. What happens if 61.8 fails to hold?

Price may continue toward 78.6% or even 100%, indicating deeper reversal potential.

4. Do professional traders use the golden ratio?

Yes. It’s a standard component of institutional-level technical analysis.

5. Can I rely on 61.8 alone?

No. Always combine it with price action, indicators, or trend confirmation tools.